Small Business VAT Registration Threshold Explained

Everything you need to know about the VAT registration threshold after April 2024.

Key Highlights

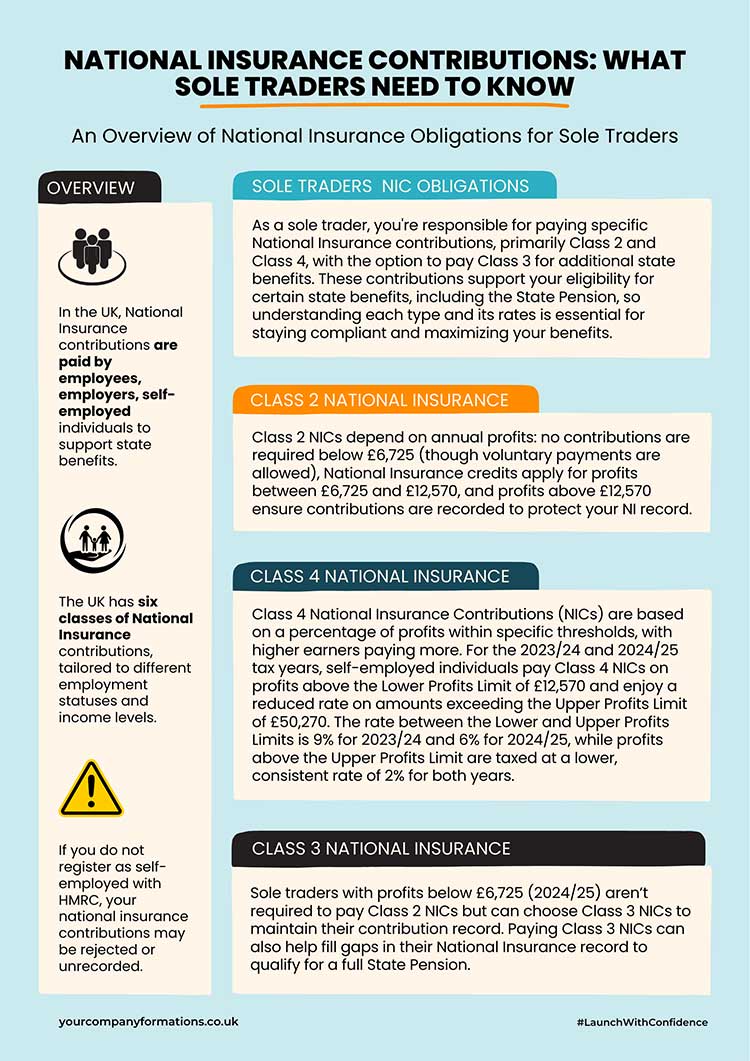

Class 2 NI contributions are a vital component of the UK’s tax system for self-employed individuals. Traditionally, these flat-rate contributions were designed to help fund essential state benefits, such as the State Pension and Maternity Allowance.

Although recent reforms have partially abolished Class 2 NI, they still significantly protect certain taxpayers and ensure continued entitlement to contributory benefits.

Class 2 NI are flat-rate weekly payments made by most self-employed individuals between 16 and the State Pension age. These contributions entitle individuals to certain state benefits. The contributions provide entitlement to contributory state benefits such as the State Pension, Maternity Allowance, and Employment & Support Allowance.

See also: How to Register for Self Assessment Tax Return on GOV.UK.

Class 2 NICs are payable based on your profits for a specific financial year as follows:

For both the 2023/24 and 2024/25 tax years, Class 2 NI contributions are set at £3.45 per week, amounting to £179.40 for an entire year (52 weeks), at the Small Profits Threshold of £6,725 annually.

On 6 April 2024, self employed individuals with profits above £12,570 will no longer have to pay Class 2 NI but will still be entitled to contributory state benefits. National Insurance credits are automatically given to those earning between £6,725 and £12,570 to secure their entitlement to contributory benefits, including the State Pension and other support.

Individuals with profits below £6,725 do not need to pay Class 2 national insurance. However, they can make voluntary contributions at £3.45 per week to secure their entitlement to state benefits. This option helps lower earners protect their National Insurance record and qualify for the same benefits as those with higher earnings.

Insight

According to the government, if Class 2 NICs were to be abolished, low-income self employed individuals would need to pay the more expensive Class 3 NICs (£17.45 per week) to maintain benefit entitlements.

Sole Traders & National Insurance Contributions

See also: Sole Trader (or Sole Proprietorship) Explained.

Subscribe to our newsletter and join the ranks of 100,000+ entrepreneurs who receive weekly insights, legal updates, and compliance reminders directly in their inbox.

Class 4 NICs are calculated based on a percentage of earnings within set thresholds. The rates are structured to ensure that higher earners contribute more, with a reduced rate for profits exceeding the Upper Profits Limit.

Below is a breakdown of the 2023/24 and 2024/25 tax years rates.

| £ per year | 2024/25 | 2023/24 |

|---|---|---|

| Lower Profits Limit Self-employed people pay Class 4 National Insurance on profits above the Lower Profits Limit. | £12,570 | £12,570 |

| Upper Profits Limit Self-employed people pay a lower rate of Class 4 National Insurance on profits above the Upper Profits Limit | £50,270 | £50,270 |

| Rate between Lower Profits Limit to the Upper Profits Limit | 6% | 9% |

| Rate above Upper Profits Limit | 2% | 2% |

Both are self-employed national insurance contributions. The difference depends on the benefits each contributes to, the threshold for contributing to each class and your overall NI records.

The differences are outlined below.

| Difference | Class 2 NI | Class 4 NI |

|---|---|---|

| Who pays | Self employed individuals with income below £6,725 pay voluntarily | Self-employed with profits of more than £12,570. |

| Rate | £3.45 per week. | 6% on profits £12,570 – £50,270; 2% above £50,270. |

| Benefit entitlement | State Pension, Maternity Allowance, Employment & Support Allowance. | Contributes to your overall NI record. |

| Deemed payment | Contributions are deemed to be paid for those earning between £6,725 and £12,570. | No deemed payments are based purely on actual contributions. |

| NI credits | National Insurance credits are given to those with profits between £6,725 and £12,570. | No National Insurance credits available. |

If you do not pay Class 2 NIC through Self-Assessment, you will need to register with HMRC to make these payments. Once registered, HMRC will send you a payment request by the end of October detailing how much you need to pay.

The request will specify the deadline by which you must pay HMRC. Be sure to allow enough time for your payment to be processed before the deadline, as the processing time can vary depending on the payment method you choose. However, a person with more than one job can defer paying national insurance until after the end of the tax year.

See also: National Insurance Category Letters Explained.

Several payment methods are available for those who want to pay voluntary Class 2. When selecting a process, consider the processing times to ensure your payment reaches HMRC on time.

Below is a breakdown of the available payment options and timelines.

| Payment methods | Processing timeline. |

|---|---|

| Online or Mobile Banking (UK Residents) | Up to 2 hours |

| CHAPS (Clearing House Automated Payment System) | Same working day |

| Bacs (Bankers’ Automated Clearing System) | 3 working days. |

| Direct debit | 3 working days |

| Standing order | 3 working days |

| HMRC Bank Details for Faster Payments, CHAPS or Bacs | |

Self-employed individuals are responsible for paying both Class 2 and Class 4 national insurance based on their profits. In contrast, employed individuals pay Class 1, with contributions divided between the employee and the employer. The employee’s portion, known as the primary contribution, is deducted directly from their salary, while the employer pays an additional amount, known as the secondary contribution, on the employee’s behalf. This system ensures both parties contribute toward the employee’s National Insurance record and future benefit entitlements.

See also: GOV.UK Employer PAYE Reference Number 2024 Explained!

Disclaimer: This blog is for informational purposes only and reflects our understanding of the topics discussed. It should not be considered tax advice. Please consult a qualified tax advisor for personalised guidance.

Excellent article! It was helpful learning about the national insurance contributions for my own financial services UK.