Small Business VAT Registration Threshold Explained

Everything you need to know about the VAT registration threshold after April 2024.

Key Highlights

A shelf company, also known as an off-the-shelf company or a ready-made company, is a pre-registered business that entrepreneurs purchase. A registering agent sets it up with generic details, such as a placeholder company name, and registers it with Companies House as a dormant company. It is then effectively “stored for future use,” remaining inactive until sold. Buyers can later customise aspects like the shareholding, directors, and company name to suit their specific requirements.

A shelf company is formed like a regular limited company, meeting the standard registration requirements. However, these details are prepared with the expectation that they will be altered to suit the buyer’s needs. Typically, a shelf company includes:

A generic company name

A non-specific SIC code

A simple, ordinary share structure

Generic memorandum and articles of association

The agent’s registered office address and email address and email address

Dormant company accounts to validate its non trading status

A single director who is also the sole shareholder, often the registering agent or their employee

These features make it a basic, dormant entity, ready for customisation upon purchase.

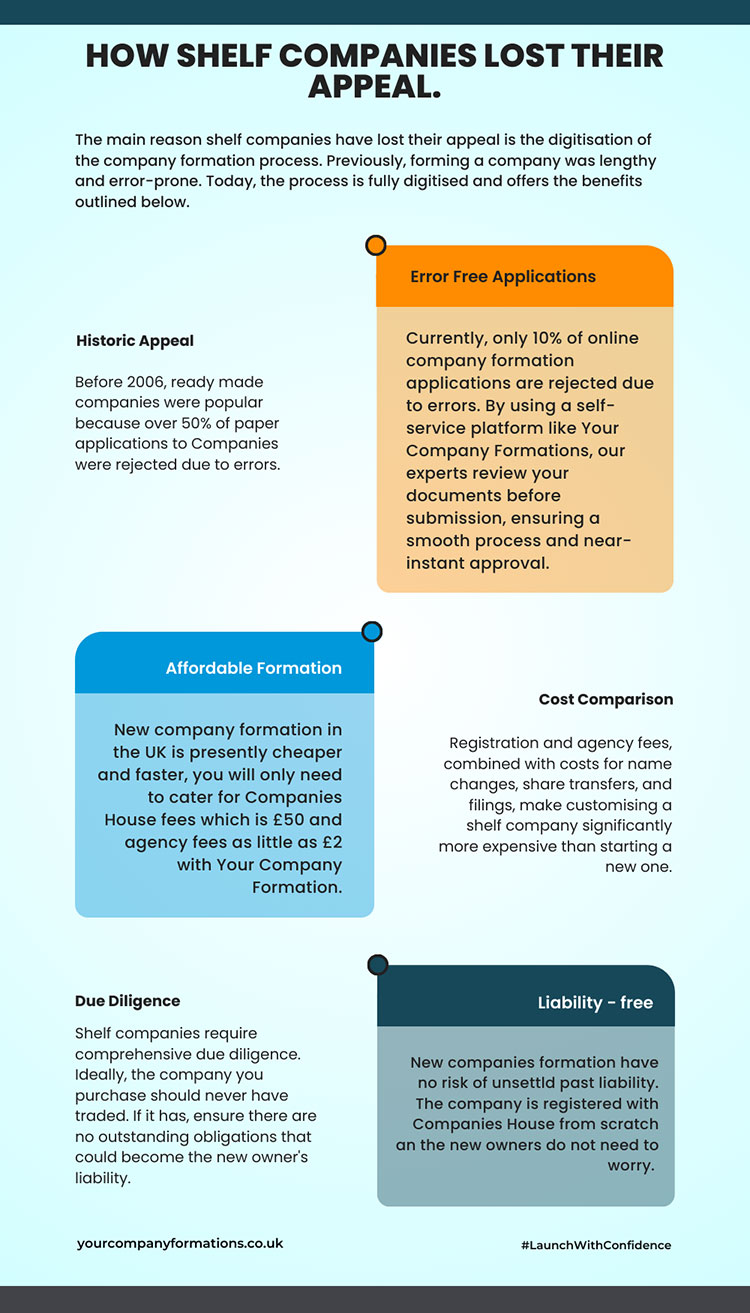

Over time, the appeal and practicality of buying a shelf company have significantly diminished, largely due to advancements in digital processes. Today, forming a new company in the UK is affordable and can be completed in as little as three hours.

Over 20 years ago, this wasn’t the case. Company formation was a lengthy and tedious process, requiring paper applications. At the time, more than 50% of applications were rejected due to errors or missing details. In contrast, the introduction of streamlined online registrations has reduced rejection rates to just 10%.

As a result, the once-common reliance on shelf companies has been largely replaced by the ease and efficiency of modern company formation processes. This shift has made registering a new company the more practical and cost-effective option for entrepreneurs.

Insight

In 2006, the UK introduced electronic company formation, enabling businesses to submit incorporation applications online. This innovation streamlined the company formation process, eliminating the need to wait weeks for approval. Electronic registration also reduced errors in application documents. As a result, it has become faster and more cost-effective to register a company from scratch rather than purchasing a shelf company.

Subscribe to our newsletter and join the ranks of 100,000+ entrepreneurs who receive weekly insights, legal updates, and compliance reminders directly in their inbox.

No, buying a shelf company is now more expensive and less practical than forming a new company. Below is a breakdown of the costs and considerations from the entrepreneur’s perspective.

| Aspect | Shelf Company | New Company Formation |

|---|---|---|

|

Registration |

A 2023 shelf company can cost up to £300 |

It costs as little as £2 |

|

Efficiency |

Already registered, but requires additional applications to make changes |

Ready to trade within as little as 3 hours. |

|

Customisation |

Additional costs for changing name, shareholding, and director details |

Fully customised during the registration process |

|

SIC code |

Requires changes |

Selected at the time of registration |

|

Memorandum and articles |

Generic and may require updates |

Customised at registration with bespoke formation packages |

|

Overall costs |

Higher due to added customisation fees |

Lower and straightforward |

Yes, you will receive a certificate of incorporation when you buy a shelf company. The incorporation date will reflect the original date the company was registered. If you choose to change the company’s name, you will also receive a certificate of name change once Companies House processes the update.

When purchasing a shelf company from registration agents, you should receive the following documents:

Certificate of Incorporation: Confirms the company’s legal existence.

Memorandum and Articles of Association: Outline the company’s structure and operational rules.

Certificate of Change of Company Name : Provided if you choose to rename the company.

J30 Stock Transfer Forms: Used to transfer shares to the new owners.

Dormant Company Accounts: Verify that the company has not been actively trading.

Confirmation Statement: Reflects updated director and shareholder details according to your preferences.

These documents ensure the company is legally compliant and customised to meet your needs. Always confirm their accuracy before proceeding.

Warning

Use the Companies House Search service to thoroughly review the company’s history before purchasing. Look for a shelf company that has been dormant since its inception. Where applicable, pay close attention to its confirmation statements, annual accounts, and dormant accounts. The primary risk of buying a shelf corporation is inheriting a business with unresolved obligations, which could become your responsibility. Conducting due diligence helps you avoid these pitfalls and ensures you are starting on a clean slate.

To update these details, you will need the following:

J30 Stock Transfer Form: To transfer shares and update shareholder information.

Form AD01: To amend the director’s and registered office addresses.

Confirmation Statement: To officially record and file the changes with Companies House.

Ensure all forms are accurately completed and submitted to keep your company records up-to-date and compliant.

The company formation agent who originally registered the shelf company typically manages the share transfer. Upon purchase, you will need to provide the necessary information for the share transfer process. In many cases, the cost of the shelf company includes the expenses for customising it to meet your requirements, including updating shareholder details. Always confirm what services are included in the price to avoid unexpected costs.

Yes, you can customise the shareholder structure of a shelf company to meet your specific requirements. This includes replacing the placeholder shareholders and allocating shares according to your internal agreements. Additionally, you can appoint new directors to align with your business needs.

Yes, you can change the company name to align with your brand identity and industry. This allows you to create a name that better reflects your business and its goals.

It depends on your circumstances. Registering a new company might be a better option if you’re considering a shelf company for quick market entry since it can take as little as three hours. For other reasons, remember that you’ll still need to change the company’s name and ownership structure and start from scratch to build its reputation.

Additionally, a shelf company does not provide a way to avoid scrutiny under the current legislative framework for corporate transparency. Given these factors, registering a new company is often a more practical and cost-effective choice.

While you can customise a shelf company to meet your business objectives, registering a new company tailored to your needs is often the better choice. With a tailor-made company, you don’t have to worry about inheriting potential liabilities or pending obligations associated with a shelf company. Additionally, you can structure the company according to your preferences, ensuring it aligns with your goals and interests. This makes a tailor-made company more desirable for most entrepreneurs.