GOV.UK Construction Industry Scheme (CIS) Explained

By the Construction Industry Scheme (CIS), contractors deduct 20% from registered and 30% from unregistered subcontractors as advance tax payments.

Subscribe to our newsletter and join the ranks of 100,000+ entrepreneurs who receive weekly insights, legal updates, and compliance reminders directly in their inbox.

By the Construction Industry Scheme (CIS), contractors deduct 20% from registered and 30% from unregistered subcontractors as advance tax payments.

The sole trader business structure suits self-employed individuals registered for self-assessment and seeking to manage their businesses.

If you are a contractor, self-employed, employee, or director working for an employer, discover how your employment status affects your income tax.

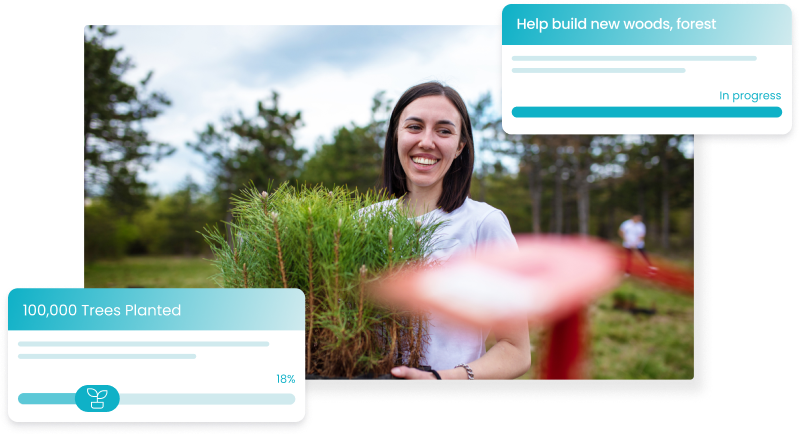

Start your company with good vibes. Your Company Formations team will plant a tree with every new client order. Thousands of trees planted and growing rapidly!