Small Business VAT Registration Threshold Explained

Everything you need to know about the VAT registration threshold after April 2024.

Subscribe to our newsletter and join the ranks of 100,000+ entrepreneurs who receive weekly insights, legal updates, and compliance reminders directly in their inbox.

Everything you need to know about the VAT registration threshold after April 2024.

Also known as a ready-made company or an off-the-shelf company, a shelf company is a pre-registered business you can buy and customise.

Ensure compliance and avoid penalties by checking that a UK or EU VAT registration number is valid.

A VAT number or VAT registration number is a unique identifier for reporting and remitting value-added tax for UK and EU businesses.

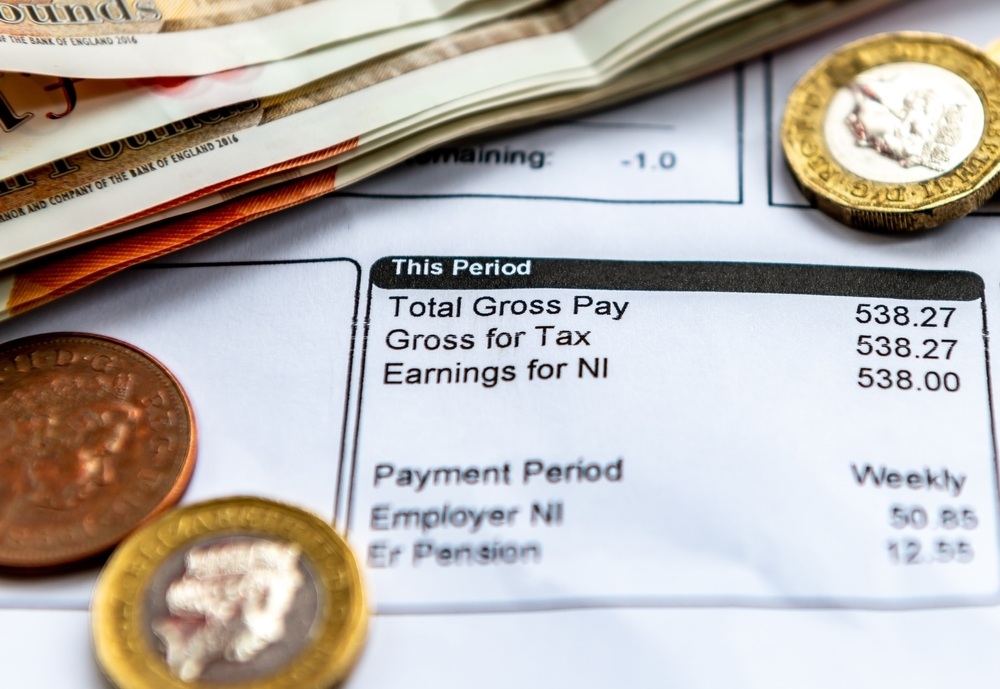

After the personal allowance, income tax rates for the 2024/25 tax year are 20% (up to £50,270), 40% (£50,271 to £125,140), and 45% (above £125,140).

The meaning behind national insurance category letters, including the latest changes and how to determine the correct NI category for your contributions.

The UK dividend tax rate for the 2024/25 tax year is 8.75% basic rate and 39.35% additional rate. See how to maximise your tax-efficiency as a director.

Start your company with good vibes. Your Company Formations team will plant a tree with every new client order. Thousands of trees planted and growing rapidly!