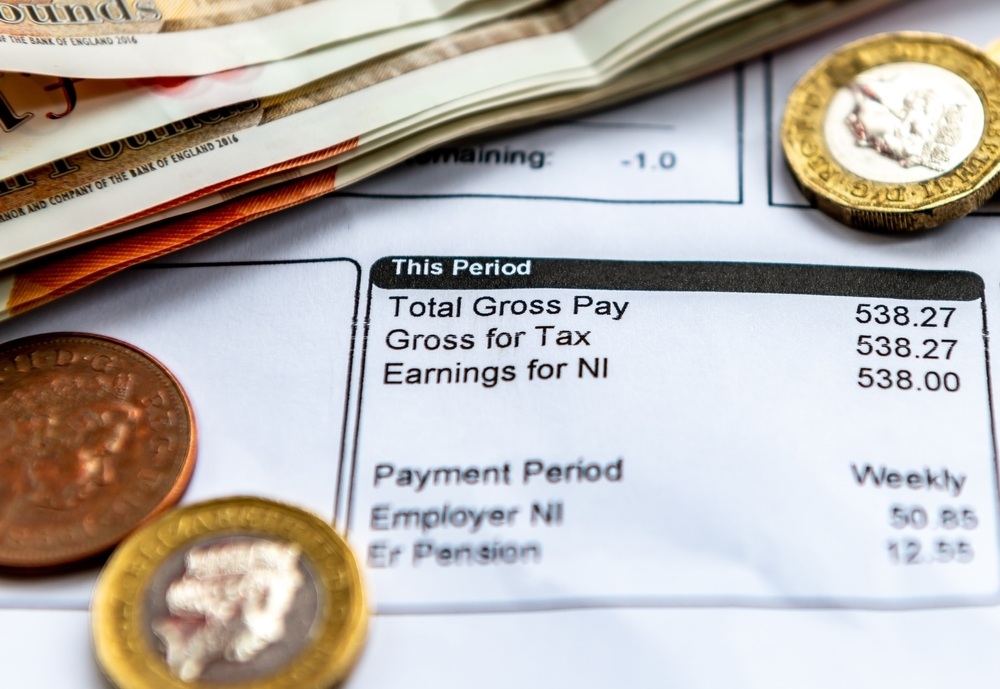

National Insurance Category Letters Explained

The meaning behind national insurance category letters, including the latest changes and how to determine the correct NI category for your contributions.

Subscribe to our newsletter and join the ranks of 100,000+ entrepreneurs who receive weekly insights, legal updates, and compliance reminders directly in their inbox.

The meaning behind national insurance category letters, including the latest changes and how to determine the correct NI category for your contributions.

The UK dividend tax rate for the 2024/25 tax year is 8.75% basic rate and 39.35% additional rate. See how to maximise your tax-efficiency as a director.

A summary of the announcements on Labour Autumn Budget 2024, delivered by Chancellor of the Exchequer Rachel Reeves, impacting business.

From 6 April 2024, Class 2 National Insurance Contributions are voluntary for self-employed individuals earning below the small profits threshold of £6,725.

Explore the major UK employment law changes effective, including enhanced worker rights, flexible working, and protections against redundancy.

Unlock the process of changing your limited company name by special resolution and essential legal considerations.

Everything you need to know about the new requirement by Companies House for UK companies to maintain a registered email address by March 2024.

Start your company with good vibes. Your Company Formations team will plant a tree with every new client order. Thousands of trees planted and growing rapidly!