GOV.UK Construction Industry Scheme (CIS) Explained

By the Construction Industry Scheme (CIS), contractors deduct 20% from registered and 30% from unregistered subcontractors as advance tax payments.

Key Highlights

A Company Registration Number (CRN), also known as a “Companies House Number” or “Company Number,” is a unique identifier assigned to limited companies and LLPs when they are registered with Companies House. While company names can share similar words or phrases with other businesses, the CRN is unique and valid for the life of the company, and no two companies will have the same number.

Find out more: GOV.UK One Login Programme Explained!

A CRN is a unique identifier for UK companies. It is typically 8 characters long, 8 digits or 2 letters followed by 6 digits.

Eight digits (e.g., 12345678)

Two letters followed by six digits (e.g., AB123456)

However, the exact format can vary depending on the location and type of company:

8-digit number: Companies formed in England and Wales

“OC” prefix: LLPs in England and Wales

“LP” prefix: Limited Partnerships in England and Wales

SC” prefix: Companies formed in Scotland

“SO” prefix: Scottish Limited Liability Partnerships (LLPs)

“SL” prefix: Scottish Limited Partnerships

“NI” prefix: LTDs in Northern Ireland

“NC” prefix: LLPs in Northern Ireland

“NL” prefix: Limited Partnerships in Northern Ireland

Read also: A Guide to Private Limited Company Secretary

Sole traders do not receive CRNs because they register with HMRC rather than Companies House. Similarly, general partnerships, also known as ordinary partnerships, do not have a business identification number as the registrar of companies does not incorporate them.

Only a limited company or limited liability partnership are given a company registration number.

See also: Guide to Public Limited Companies (PLC)

Subscribe to our newsletter and join the ranks of 100,000+ entrepreneurs who receive weekly insights, legal updates, and compliance reminders directly in their inbox.

There are a few places where you can locate your CRN:

Certificate of incorporation: Once you set up a limited company, you will find your crn in the registration certificate.

Companies House correspondence: Look for your CRN on any official mail from Companies House. It’s usually printed alongside or beneath headings like “Company No.”

Correspondence from advisors: Communications from advisors such as your company formation agent or accountant may also include your CRN.

Online public register: You can find your company identification number through the Companies House Search service by following the steps below.

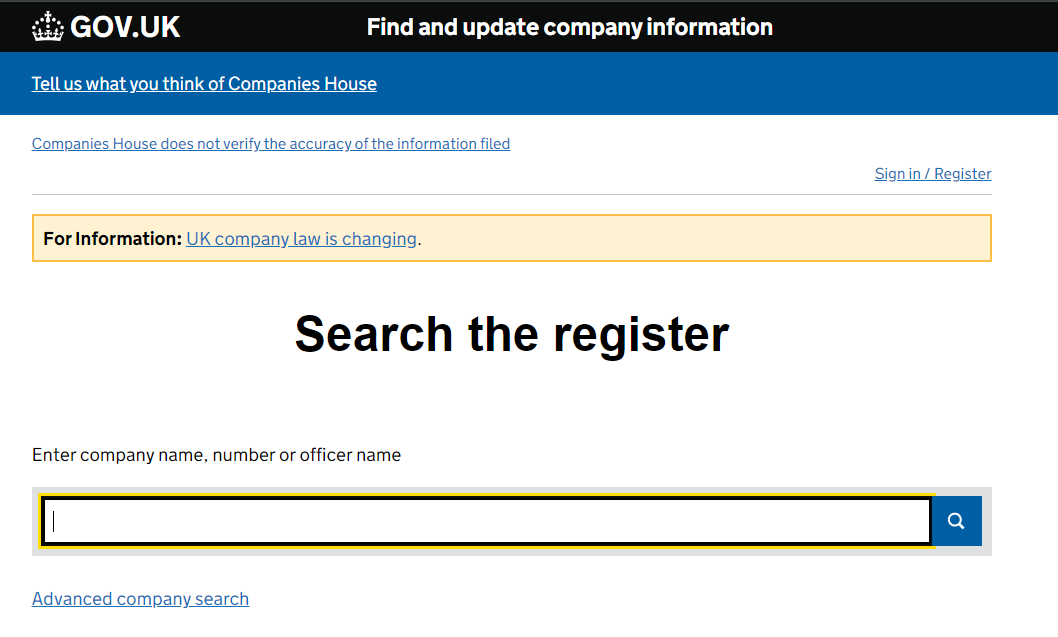

Visit: https://find-and-update.company-information.service.gov.uk/

To search for a company, enter its name in the search box.

Click the “SEARCH” button.You’ll see a list of all UK companies with names that match yours, in part or full. For instance, if your company is named “GreenTech Solutions,” the search results might include similar names like “GreenTech Innovations,” “GreenTech Services,” or “EcoGreenTech Solutions.” The list will include the registered office addresses to help you identify and select the correct company.

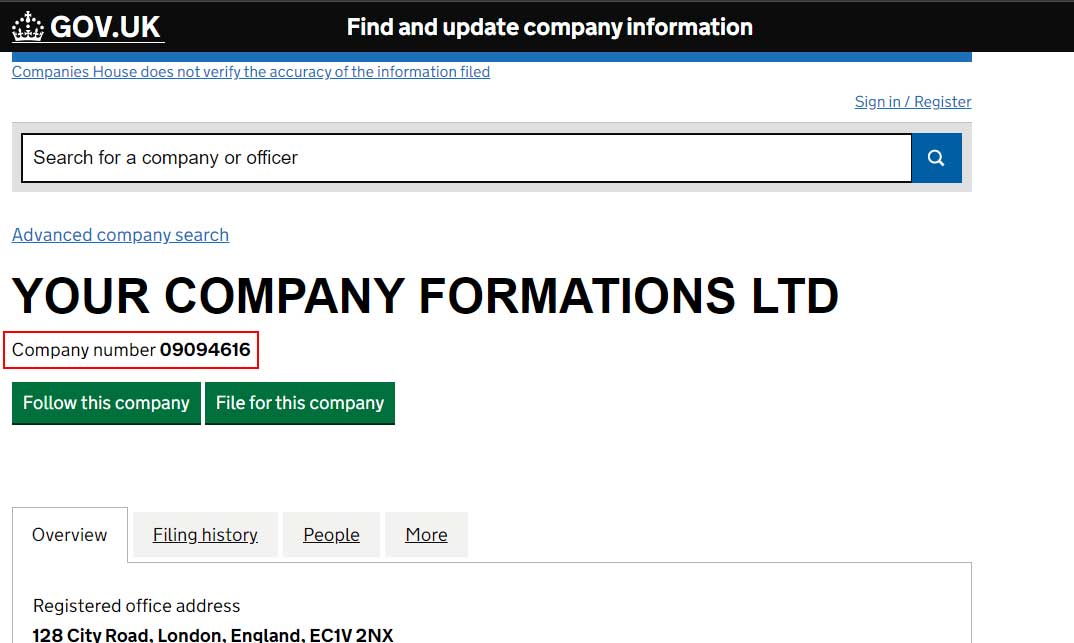

Click on the company of interest.

The crn is below the company name and is labelled “Company Number.”

Your CRN is a crucial element of your business identity. As a limited company, the law requires that you display the number on all official business stationery and communication. This helps to ensure transparency and compliance with UK company law.

You should include it in the following official company stationery:

By consistently displaying your registration number on these items, you comply with legal requirements and present a professional and credible image to clients, partners, and stakeholders.

Discover: Free Company Name Check tool Linked to Companies House Register

You can use a company number to determine a business’s previous name. When you search using the CRN, the search results will display only the company associated with that unique registration number. After selecting the company, scroll down the page, and you will find a section that lists any previous names the company has used.