Small Business VAT Registration Threshold Explained

Everything you need to know about the VAT registration threshold after April 2024.

Key Takeaways

80% of working millionaires are self-employed. Therefore, if you are considering starting a business, you are about to take one of the most viable paths to financial freedom. For your benefit, we’ve put together this ultimate guide on how to set up a business, offering practical advice, and critical resources.

Whether you simply just have a great business idea, considering funding options, or are ready to incorporate, this guide offers insights to help you take those critical first steps to start a company and elevate.

Let’s dive in and explore the exciting world of UK entrepreneurship!

If you have any queries about starting your own business, don’t hesitate to contact us for assistance. Call us today at 0207 689 7888 or email info@yourcompanyformations.co.uk to consult with one of our experts at no cost. We’re here to help you launch with confidence.

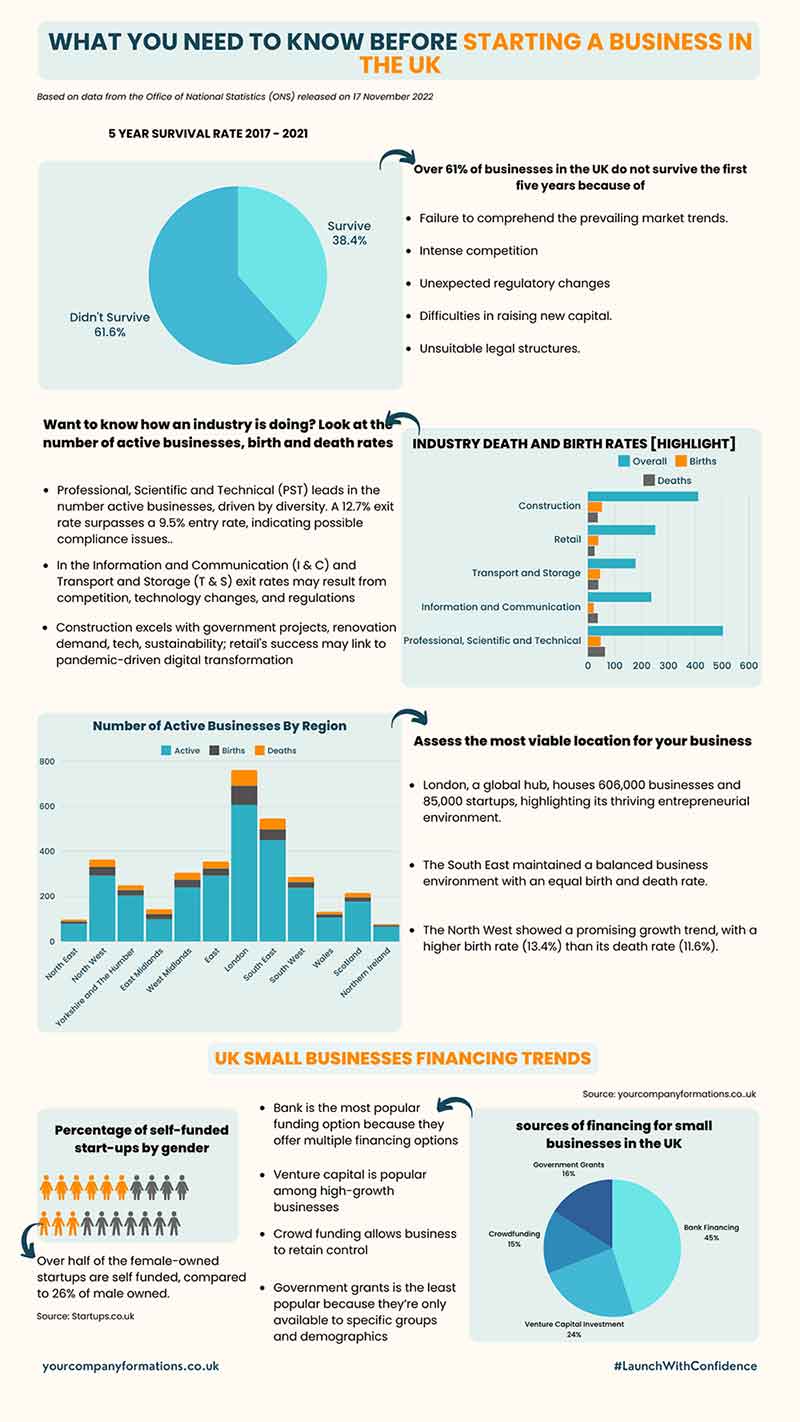

According to the Office of National Statistics (ONS), 92.9% of businesses in the UK survive their first year. Of these, only a third make it past five years.

Study shows that the top five factors contributing to businesses not reaching their five-year milestone are –

These five points form the basis of this guide. Each section seeks to uncover the knowledge and insights you need to lay a solid foundation for your business.

A comprehensive understanding of the survival rates of businesses in your prospective industry can help you choose the best idea and sector for your business.

To illustrate, in this section, I’ll assess the performance of five industries using the 2021 census data from ONS. The industries in our focus are —

Key metrics, like the number of active businesses, birth (entry), death (exit), and survival rates, highlight various challenges and opportunities.

To illustrate, from the census data snapshot captured above, it’s clear that the Professional, Scientific, and Technical (PST) industry stands out with the highest number of active entities. The diverse mix of businesses within this space, from legal services to architectural firms, pharmaceutical companies, and scientific research businesses, might be a factor.

Insight

It is evident that the industry lends itself well to professionals thinking of registering as a sole trader as a starting point before venturing into a limited company formation structure.

Yet, despite its buzzing activity, the PST sector also sees a slightly higher exit rate at 12.7%, compared to the entry rate of 9.5%. Our experience suggests that the high entry standards due to public safety concerns could play a role here. For instance, regulators require healthcare-based operators, such as pharmacies within PST, to have a pharmacy degree. Entry requirements to such programs include Mathematics, Biology, and other rigorous subjects. Because of the high academic requirements, most pharmacies face a shortage of qualified personnel.

The snapshot also shows that the Information and Communication (I & C) and Transport and Storage (T & S) industries also experience high exit rates. The rate may reflect the demanding environment within these sectors, influenced by intense competition, rapid technological advancements, and strict regulatory conditions. For instance, the semiconductor sector, which affects both communication and transport industries, has been contending with a shortage of input materials and increased cost of components since the pandemic, leading to business closures.

Of the industries in this highlight, construction and retail show the highest survival rates. For construction, the reasons behind its resilience may include government infrastructure projects that sustained housing demand, especially during the COVID lockdown periods, and an upswing in renovation and remodelling activities. Technological innovations and a shift towards sustainable building methods further enhanced industry growth.

The resilience of the retail industry, on the other hand, may be attributed to the accelerated digital transformation during the pandemic. Online businesses with a strong presence or those swift to transition to e-commerce proved exceptionally resilient. Additionally, companies that showed agility, such as implementing contactless delivery and pickup options, fared well amidst adversity. To stay successful, retailers must anticipate consumer trends, adopt advanced technology, and provide an effortless omnichannel shopping experience.

Insight

Business owners considering entry into any industry should carefully assess market conditions and develop strategies to address industry-specific challenges. Additionally, it is worth noting that businesses with a robust online presence, even those outside of retail, demonstrate greater resilience than those without.

From the preceding, as it has been our experience, some of the best businesses take time to understand and plan for the opportunities and challenges within their landscapes. To keep your business going in the UK, you ought to be able to navigate industry-specific hurdles and have a robust risk assessment approach to ensure long-term success.

Want to know more than just survival rates? Explore the Companies House search service. It’s a handy tool that allows you to delve into the details of businesses in your targeted niche, from ownership structure to performance.

Use the self-assessment questions below if you seek to establish a venture in any particular industry.

Subscribe to our newsletter and join the ranks of 100,000+ entrepreneurs who receive weekly insights, legal updates, and compliance reminders directly in their inbox.

Understanding the funding landscape helps you position your business to attract the necessary financial support. Some of the top funding sources for UK businesses since 2021 include —

Based on the above information, here are some self-assessment questions you can use to assess the funding opportunities available to your venture.

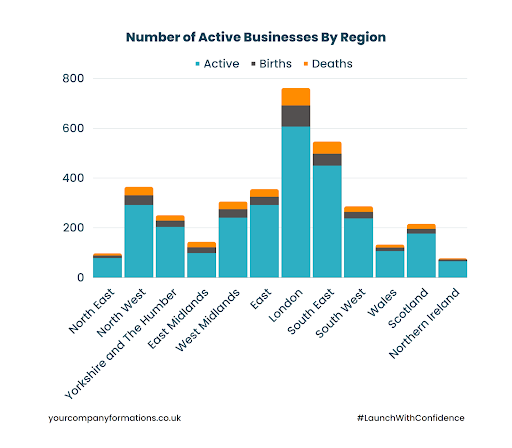

The location of your business operations can significantly affect your venture. It is crucial to investigate your chosen location for factors like customer reach, availability of skilled labour, rate of business activities, and proximity to suppliers.

According to the ONS data, London emerged as the region with the highest number of active businesses, hosting over 606,000 enterprises, thanks to its status as a global economic hub and rich startup ecosystem. It also led in new business births, with 85,000 startups contributing to a 14.1% birth rate, reflecting the city’s dynamic entrepreneurial scene.

Insight

Our strategic location in the heart of London, City Road EC1, allows us to provide a range of prestigious business addresses to enhance your new company’s image. With this, you elevate your brand’s prestige and get a layer of privacy and identity protection. Explore our innovative and bundled packages and get everything you need to launch your business with confidence.

However, this robust activity comes with risks, as illustrated by the 70,000 businesses that closed down, representing a 11.5% death rate. The data highlights the competitive nature of London’s business environment and the sustainability challenges businesses face.

Other regions like the South East and the North West, with 449,000 and 291,000 active businesses, respectively, also demonstrate substantial economic activity. The South East maintained a balanced business environment with a 10.8% birth and death rate. The North West showed a promising growth trend, with a higher birth rate (13.4%) than its death rate (11.6%).

While London dominates the UK business landscape, other regions offer significant opportunities. The birth and death rates in these areas represent their business vibrancy, with the challenge for startups being to navigate these environments to achieve lasting success effectively.

Categorising legal structure according to liability is crucial as it enables small business owners to assess the level of personal risk and financial responsibility associated with starting up a company in the UK.

Infographic: Personal liability structure vs limited liability structure

Personal liability businesses such as sole traders and partnerships have the simplest legal structures. These formats have no real separation between business and individual finances; therefore, owners are personally liable for business debts, putting their assets at risk. Also, HMRC requires owners to register for self-assessment tax returns.

In contrast, limited liability structures like Limited Liability Partnerships (LLP) and Limited Companies (LC) pay corporation tax on profits and protect owners’ assets. The format is designed to separate business and personal finances and limits the founder’s liability to their investment.

Understanding the distinction between personal and limited liability structures helps you choose a model that suits your idea, risk tolerance, industry and goals. It also influences essential issues such as the ability of your venture to secure financing, attract investors, and enter into contracts.

By grasping the implications of liability, you ensure that the structure of your business aligns with your needs, safeguards your assets, and establishes a solid foundation for long-term business growth.

Once you’ve identified a brilliant business idea and the ideal legal structure that aligns with your goals and industry, the next step is forming your business.

Registration legally validates your venture and sets the groundwork for its operations. Forming your business with a company formation agent can simplify this process, as they can handle the necessary paperwork and liaise with the relevant authorities on your behalf. A dependable agent lets you focus on other essential aspects of setting up your business, such as developing your plan, securing funding, and laying out your market strategy.

Infograpphic: UK Business Startup data

Keeping track of your finances is crucial in the initial stages as you start a business UK. One practical step towards achieving this is setting up a free business account.

Free bank accounts provide multiple benefits explicitly designed for startups. They offer the essential foundation for managing business finances, separating personal and business expenses, and helping present a professional image to clients and suppliers.

When setting up your free bank account, consider a few key factors:

Register through a company formation agent and get a free bank account that best suits your business and financial management needs.

You might require additional funding to finance the initial stages of starting your business. A viable route to explore is applying for a government-backed Start Up Loan.

Start-up loans are personal loans offered by the UK government for business purposes. They can provide a fantastic kick-start, offering low-interest business rates and free mentoring for your start-up.

When applying for a start-up business loan, you need to meet specific criteria:

Securing a government-backed Start-Up Loan can give your business the essential capital to grow while offering beneficial support and guidance. It’s a fantastic resource for start-ups looking for a financial boost to set them on the path to success.

Building a successful business entails gathering the right tools and resources to ensure a seamless launch and continued growth. Here’s a comprehensive list of essentials:

Read: Company UTR Number: Understanding Its Purpose and Importance

As a trusted company formation agent, our expertise lies in guiding aspiring entrepreneurs through the complexities of business formation. From understanding legal requirements and registration processes to offering practical advice and resources, we aim to empower individuals to confidently navigate the intricacies of starting a business UK. Whether you need guidance on choosing the proper business structure, understanding compliance obligations, or accessing professional services, this guide is a comprehensive resource to help you get the assistance you need to set up your business successfully.

A self-employed sole trader runs their own business as an individual. It is the simplest business structure and only requires registering for self-assessment.

See also: How to Register for Self Assessment Tax Return Using HMRC SA1 Form

The ease of starting a business UK varies based on nationality, business type, and immigration status. Consider the following before you start:

According to the latest World Bank annual ratings, the UK ranks number 8 out of 190 economies in the ease of doing business. Meaning the country offers a favourable environment for entrepreneurs and investors. The report indicates that some of the reasons behind the favourable rating are —

Below is a snapshot of what you should consider before starting a new business enterprise in the UK

The amount of money required for business immigration to the UK will depend on the type of VISA.

Please note that specific requirements and costs may vary depending on your circumstances. Always work with an immigration consultant for a smooth process.

Yes. You can buy a UK business, which can apply to be approved to sponsor you as a Skilled Worker visa, valid for up to 5 years, after which you can apply for an indefinite leave to remain, which permits you to continue working for as long as you want.

Thanks for the great insights! I would also recommend finding a reliable accountant. Having someone else handle the nitty-gritty tasks really allows you to focus on the business. Additionally, while electronic signature services aren’t essential, they do facilitate contract management.

In reply to Sarah.

Thanks Sarah for the additional insights!

Starting a business in 2024 requires careful planning, from developing a solid business plan to securing financing. One key step is setting up your financial management system early. For online businesses, ecommerce accounting is essential for tracking transactions, managing inventory, and handling taxes, ensuring your business runs smoothly right from the start.