Small Business VAT Registration Threshold Explained

Everything you need to know about the VAT registration threshold after April 2024.

Subscribe to our newsletter and join the ranks of 100,000+ entrepreneurs who receive weekly insights, legal updates, and compliance reminders directly in their inbox.

Everything you need to know about the VAT registration threshold after April 2024.

Ensure compliance and avoid penalties by checking that a UK or EU VAT registration number is valid.

A VAT number or VAT registration number is a unique identifier for reporting and remitting value-added tax for UK and EU businesses.

By the Construction Industry Scheme (CIS), contractors deduct 20% from registered and 30% from unregistered subcontractors as advance tax payments.

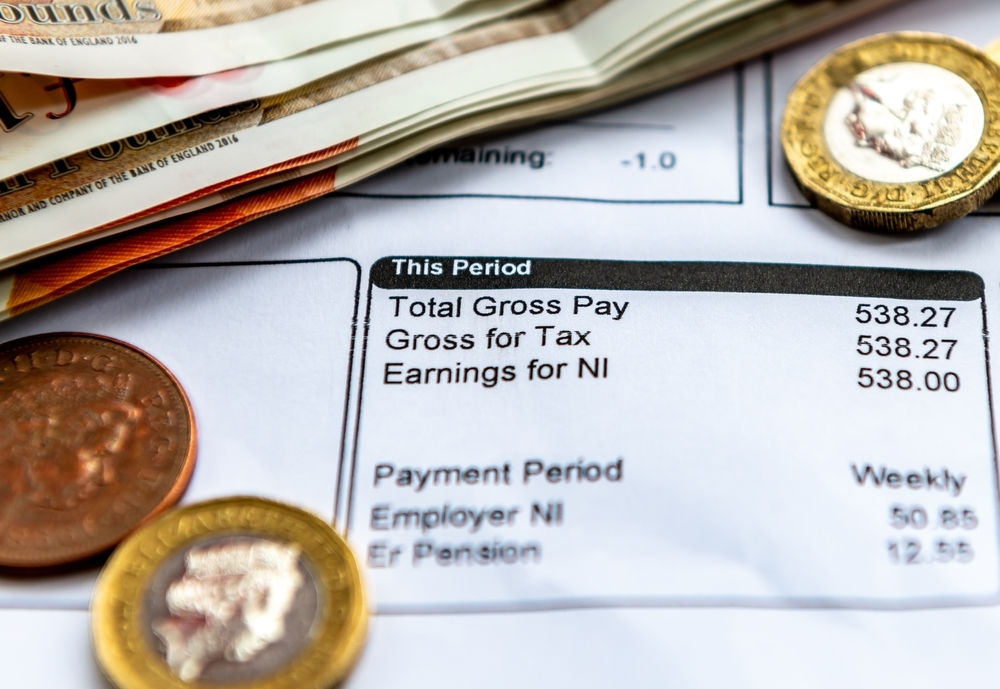

After the personal allowance, income tax rates for the 2024/25 tax year are 20% (up to £50,270), 40% (£50,271 to £125,140), and 45% (above £125,140).

The meaning behind national insurance category letters, including the latest changes and how to determine the correct NI category for your contributions.

The UK dividend tax rate for the 2024/25 tax year is 8.75% basic rate and 39.35% additional rate. See how to maximise your tax-efficiency as a director.

Start your company with good vibes. Your Company Formations team will plant a tree with every new client order. Thousands of trees planted and growing rapidly!